Critical Illness and Disability Insurance Quility

I have a medical insurance plan, should I get a Critical Illness plan as well? Zigverve

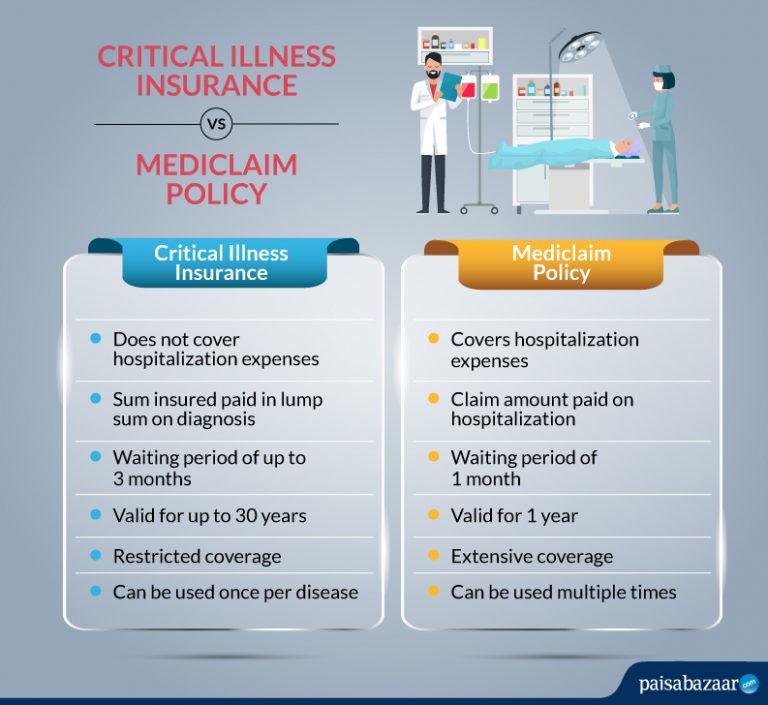

With medical insurance, a policyholder gets a certain amount of their medical costs paid for by the insurance company offering the plan. With disability insurance, the recipient gets a percentage of pre-disability base salary—usually up to 60 percent. Critical illness insurance, on the other hand, offers a lump-sum payment based on the terms.

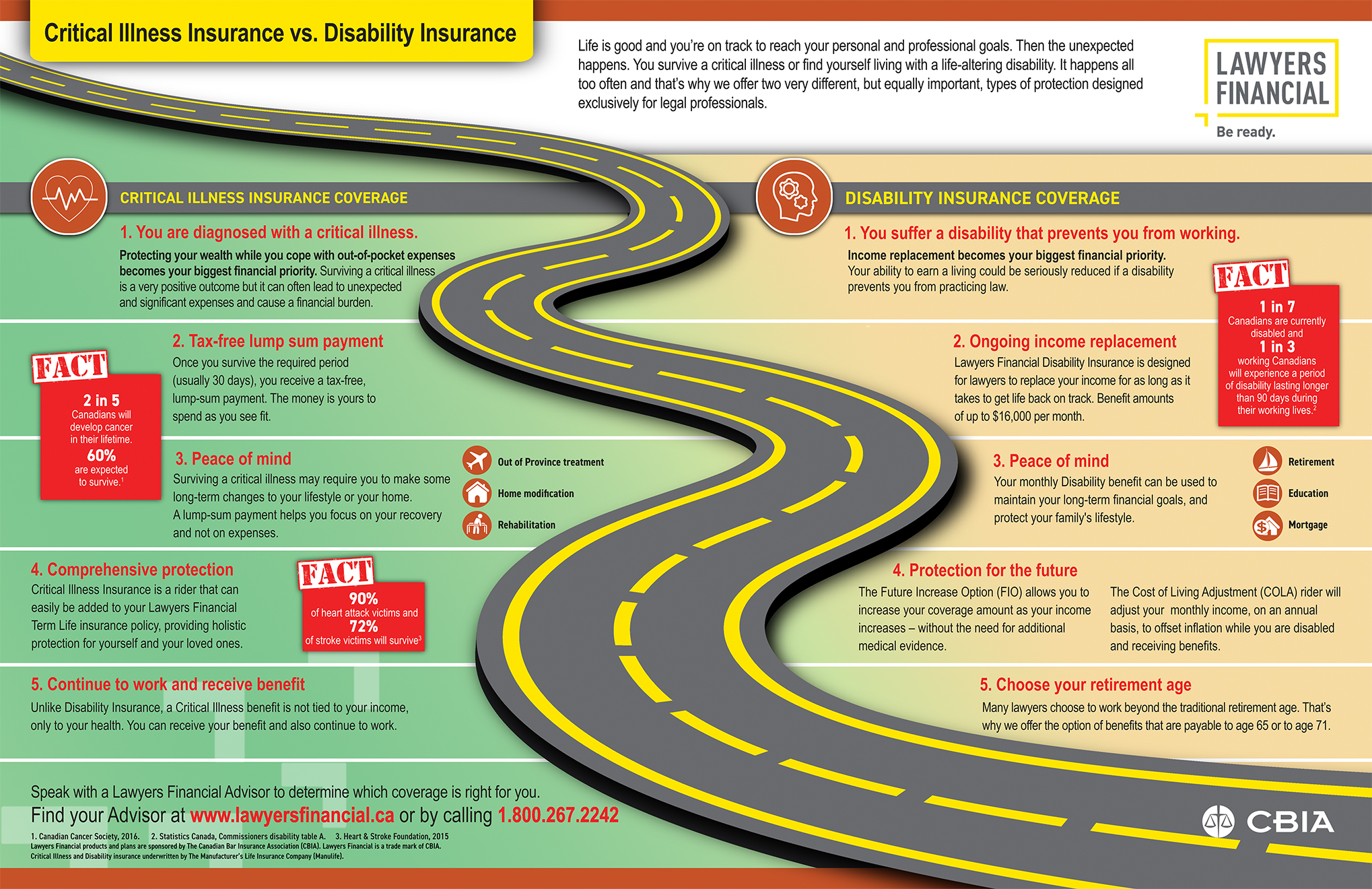

Critical Illness Insurance vs. Disability Insurance Lawyers Financial

Critical illness insurance simply pays a lump sum at the first diagnosis of the eligible illness, in amounts up to $100,000. It is more analogous to a term life insurance benefit than either long-term care or long-term disability income insurance, since the lump sum benefit is paid once and then the policy terminates.

Critical Illness Insurance Claim, Coverage & Exclusions

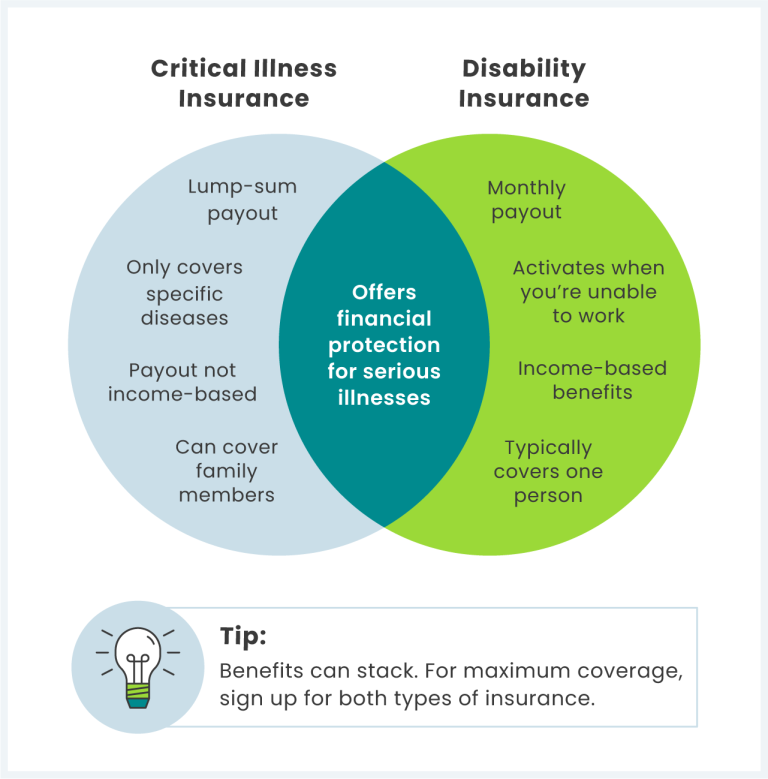

The bottom line when comparing disability insurance and critical illness insurance is that one isn't a replacement for the other. One option also isn't necessarily better than the other. They provide different types of coverage and having both may give you more protection and additional peace of mind. .

Critical Illness Insurance vs. Disability Insurance Differences!

Critical Illness Insurance. Coverage is provided as a one-time lump sum payment. It's designed to use any way you want if you experience a severe medical condition such as a heart attack, cancer, or stroke. When your self employed, you have full control over how much money you make. If you become ill and unable to work, critical illness can.

Critical Illness vs. Disability Insurance A Guide for Dentists

Critical illness insurance gives you a one-time sum of money if you're diagnosed with a severe illness. On the other hand, disability insurance gives you regular payments to replace a part of your income if you become injured or ill to the point where you can't work. By Carly Griffin. Senior Insurance Advisor, LLQP.

Critical Illness and Disability Insurance

Critical illness insurance helps provides a lump sum payout if diagnosed with a specific condition, while disability income insurance replaces lost income if unable to work due to illness or injury. Using both policy types can maximize financial protection in the event of a serious health issue. Updated October 19, 2023.

Critical Illness Insurance Vs Disability Insurance

What is critical illness insurance? Critical illness insurance is a type of supplemental insurance that pays cash benefits to a policyholder if they're diagnosed with a medical condition that's covered by the policy. Critical illness insurance is designed to be used in addition to major medical health coverage, but not replace it.

What Does Critical Illness Insurance Cover and Do You Need It

Critical illness insurance premiums often cost well under $100 a month, and may be as low as $25 a month. Liberty Mutual offers critical illness insurance premiums for as low as $12 a month — for a 35-year-old nonsmoking male in good health who would receive a $30,000 payout. Your premiums depend on factors such as: Your age Your health

Ryan Inman, Author at Financial Residency

Disability insurance supplements a portion of your monthly income if you can't work due to a serious illness or injury. On the other hand, critical illness insurance provides a lump sum payment if you're diagnosed with a covered condition. Your income or ability to work doesn't play a role in critical illness insurance, whereas disability.

How Supplemental Disability Insurance Works for Doctors

Critical illness insurance is another option available to cover the costs of a significant health event but unlike disability insurance, you are paid a lump sum rather than a recurring monthly benefit. The payout is for approved life-threatening illnesses from a predefined list, not injuries or accidents.

Disability, Critical Illness and Life Insurance post COVID19 — The Living Benefits Group

Key takeaways. Critical illness insurance coverage can provide a one-time, tax-free lump sum payment if you're diagnosed with a serious condition. If an illness or injury keeps you from working, disability insurance can give you a tax-free monthly benefit to help you pay your expenses by replacing some of your earnings.

Critical Illness and Disability Insurance Quility

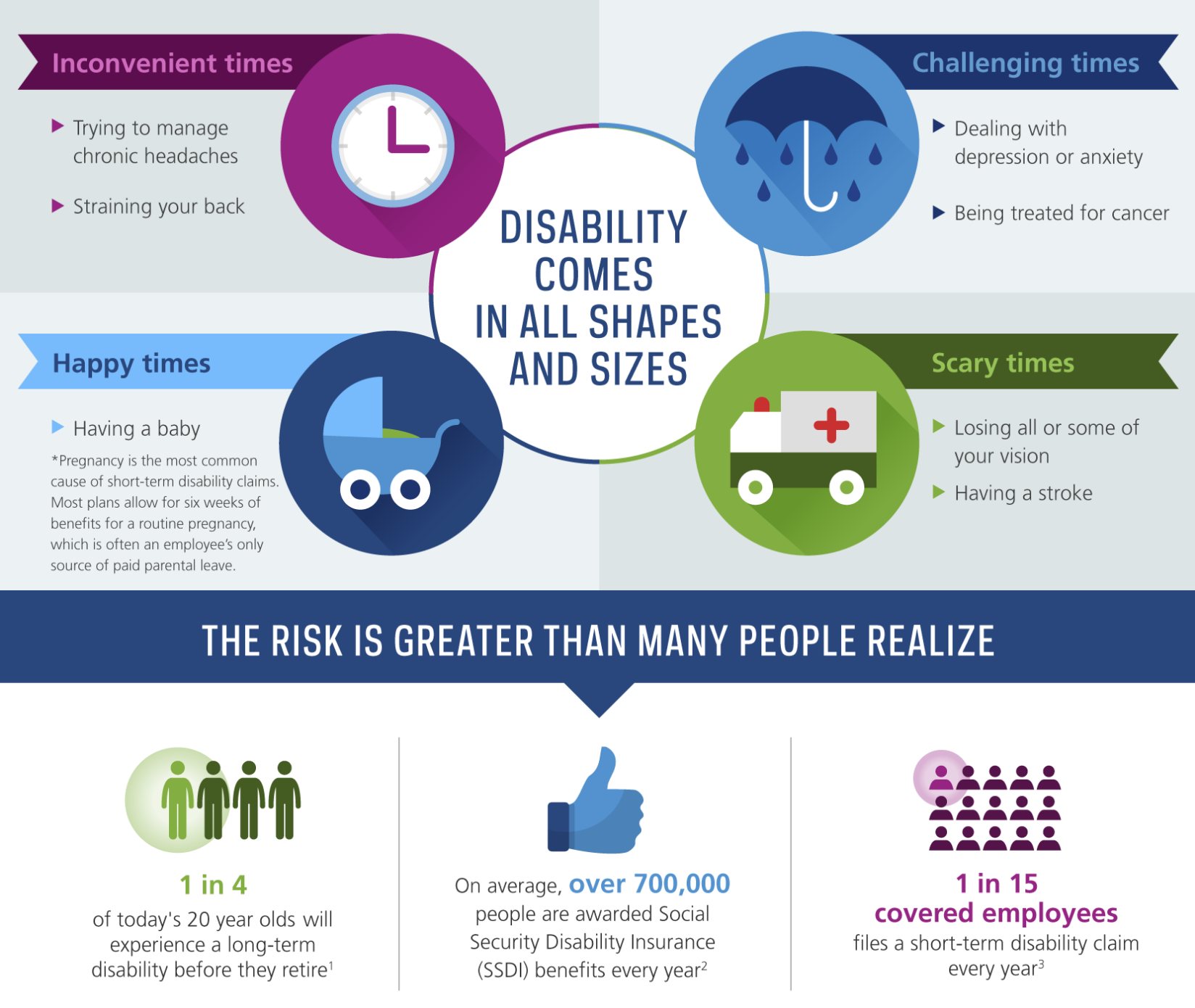

Disability insurance vs. critical illness insurance. Disability insurance and critical illness insurance both provide benefits payments when you come down with a serious condition. They also have many of the same exclusions, such as for self-inflicted injuries or injuries caused while participating in a crime or fighting in a war.

Critical Illness Insurance What Is It and Do I Need It?

Critical illness vs disability insurance: Key takeaways. Critical illness insurance covers one-time medical costs. Disability insurance replaces monthly income. Critical illness payouts are a tax-free lump sum. Disability benefits are tax-free, and replace 60-70% of income. Neither insurance type has tax-deductible premiums.

Pin on Health Condition Help

Best Critical Illness Insurance of 2024. Best Overall: Guardian Life. Best for High-Dollar Coverage: AIG Direct. Best for Customizable Coverage: Aflac. Best for Employees: MetLife. Best for Individuals: Mutual of Omaha. Best for Lifetime Coverage: UnitedHealthcare. Best for Ease of Qualifications: Breeze.

About Critical Illness Health Insurance Plan

The most popular policies are worth $50,000, according to Schmitz. For a 30-year-old man living in Iowa, a critical illness policy from Assurity would cost around $29 per month. The premiums for a.

Chronic Illness vs. Disability Key Differences SYNERGY HomeCare

Short-term disability insurance is most commonly used for temporary disabling events that last less than three months and allow for a full recovery. Think minor injuries like fractures, sprains, and strains, and maternity leave for healthy pregnancies. On the other hand, critical illness insurance is more straightforward.

.